SkallyBlinkz is set to drop a come back single title YAWA this Friday.

Keep your fingers locked as we anticipate this massive come back from the king himself…

Global Domination

SkallyBlinkz is set to drop a come back single title YAWA this Friday.

Keep your fingers locked as we anticipate this massive come back from the king himself…

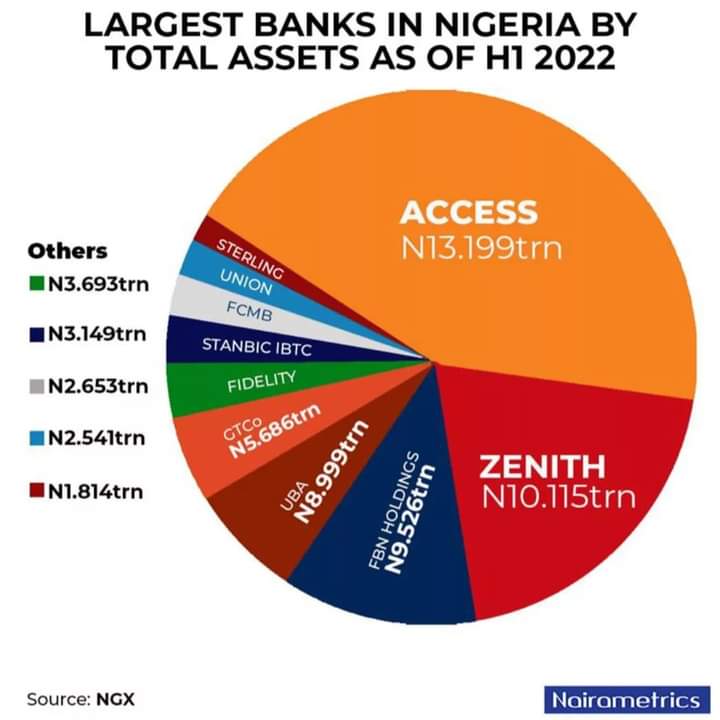

Access Bank has maintained the top spot as the largest banks in Nigeria based on the value of their total assets as of the first half of 2022. The thirteen commercial bank listed on the Nigerian Exchange (NGX) with major operations in the country saw their aggregate asset value increase by 8.1% in the first six months of the year to stand at N63.59 trillion as of June 2022 from N58.83 trillion recorded as of the beginning of the year.

The top five banks were the major tier-1 financial institutions typically referred to as the FUGAZ, which is an acronym used to represent First Bank, UBA, GTCO, Access, and Zenith Bank. The top five banks accounted for 80.5% of the total asset of the industry. It is worth noting that Ecobank Transnational Incorporated was not included in the compilation because most of its operations are outside Nigeria.

A further breakdown of the data shows that the increase in the total assets of the banks was largely attributed to rises in customer loans. Although Union Bank recorded a decline in its total assets in the period under review, Stanbic IBTC recorded the highest increase with a 14.8% increase to stand at N3.15 trillion from N2.74 trillion as of the beginning of the year.

Access Holdings Plc tops the list with a total asset value of N13.19 trillion as of June 2022, representing an increase of 12.5% compared to N11.73 trillion recorded as of the beginning of the year.

The financial institution, which is a newly restructured holding company accounted for 20.8% of the total assets of the thirteen banks under consideration. The uptick in the total asset value of the bank can be attributed to improvements in some of the asset components, especially loans and advances.

Specifically, loans and advances to customers rose to N4.62 trillion as of the period under consideration from N4.16 trillion recorded as of the beginning of the year. This means that Access Bank gave out an additional N458.2 billion in loans to its customers in the first six months of the year.

The financial institution, which is a newly restructured holding company accounted for 20.8% of the total assets of the thirteen banks under consideration. The uptick in the total asset value of the bank can be attributed to improvements in some of the asset components, especially loans and advances.

Specifically, loans and advances to customers rose to N4.62 trillion as of the period under consideration from N4.16 trillion recorded as of the beginning of the year. This means that Access Bank gave out an additional N458.2 billion in loans to its customers in the first six months of the year.

Also, investment securities rose by N493.6 billion to stand at N2.76 trillion. The value of its property and equipment increased to N261.8 billion from N247.7 billion, having spent N36.7 billion on the acquisition of property and equipment in the same period.

The bank, which is also the most capitalized bank in the Nigerian equities market, saw its loan books increase to N3.49 trillion as of June 2022 from N3.36 trillion, while investment securities stood at N1.48 trillion.

In the same vein, property and equipment improved, albeit only marginally from N200 billion to N202.3 billion. Investment securities improved from N1.3 trillion recorded as of the beginning of the year to N1.48 trillion by the end of June 2022.

FBN Holdings posted a total asset valuation of N9.53 trillion as of June 2022, representing a 6.6% increase from N8.93 trillion recorded six months earlier. FBN Holdings, which is the parent company for First Bank accounted for 15% of the total aggregate assets for the thirteen banks.

FBN’s asset growth can be attributed to increasing in its cash and balances, loan books, and investment securities. Its cash and balances with Central Bank rose from N1.59 trillion to N1.64 trillion in the six months period.

Also, its loans and advances to customers improved from N2.88 trillion as of December 2021 to stand at N3.38 trillion by the end of June 2022. It is worth adding that its investment securities rose to N2.16 trillion from N1.96 trillion.

On the flip side, its property and equipment declined marginally to N113.79 billion from N115.9 billion recorded as of December 2021.

United Bank for Africa ranks fourth on the list of biggest banks in Nigeria based on total assets with a value of 8.99 trillion, representing a 5.4% increased from N8.54 trillion recorded by the beginning of the year.

UBA accounted for 14.2% of the total asset value of the entire thirteen banks on the list. A further breakdown of the bank’s statement of financial position showed that it’s cash and bank balances improved to N1.98 trillion from N1.82 trillion recorded as of the beginning of the year.

Also, its loans and advances to customers increased to N2.75 trillion from N2.68 trillion, while loans to banks improved to N198.1 billion as of the period under review. Property and equipment stood at N183.6 billion, while investment securities at fair value stood at N1.63 trillion.

Guaranty Trust Holding Company Plc (GTCO) posted a total asset value of N5.69 trillion as of June 2022, which is 4.6% higher than the N5.44 trillion recorded as of December 2021. GTCO accounted for 8.9% of the total assets of the thirteen banks.

The banking giant, which also restructured into a holding company last year saw its cash and bank balances with the Central Bank rise to N1.04 trillion in June 2022 from N933.59 billion as of the end of last year.

Also, loans to customers increased marginally from N1.8 trillion as of December 2021 to N1.83 trillion by the end of June 2022. Meanwhile, financial assets at fair value through profit or loss improved significantly from N104.4 billion to N262.32 billion.

Fidelity Bank has N3.69 trillion

Stanbic IBTC has N3.15 trillion of asset as of 2022.

FCMB has N2.65 trillion

Union Bank has N2.54 trillion

Sterling Bank has the lowest asset with N1.81 trillion as of 2022.

Sponsored Content

The Nigerian Afrobeat music maker, Wizkid drops another sparkling project called, More Love Less Ego. The album follows up after his highly-rated project, Made In Lagos, in 2020.

The 13-track album includes features by Ayra Starr, Skillibeng, Sheen sea, Naira Marley, Skepta, and Don Toliver.

Wizkid shared the tracklist of the album in a tweet on Tuesday.

Recall that Wizkid has pushed his album release from November 4th to November 11th following the death of Davido’s son Ifeanyi.

Download

https://trendybeatz.com/artist-albums/1618/wizkid-more-love-less-ego-album

The Nigeria government has engaged in the “borrowing trend” from the year 1999 to 2007 during the Obasanjo administration it was 2.4 trillion naira, it raised from 2007 to 2011 during president yar’adua/ Jonathan to 6.17 trillion naira, 2011 to 2015 it raised to 12.12 trillion naira and from 2015 to 2021 president Buhari administration it boost to 26.91 trillion naira.

The fix rates of naira to dollar (#=$) as at the following years:

From 1999 to 2007 the price of $1 to naira was #116.8, from 2007 to 2011 it raised to #156.7, increment was made in the year 2007 to 2011 from #116.8 to #195.95 and from 2015 to 2021 it raised to #381.0.

The highest Nigeria government borrowing trends is in the year of buhari administration from 2015 to 2021 which is boost to 26.91 trillion naira while the lowest amount borrowing trends is in the years 1999-2007 during obansojo administration which was 2.4 trillion naira.

So far, Buhari is the country’s biggest

borrower, increasing public debt (FG

component) by more than 173 percent.

The current government violates important

financial laws in the country – the Fiscal

Responsibility Act, and the CBN Act 2007.

Last year, the government exceeded the

fiscal borrowing threshold as stipulated in

the fiscal act.

Zainab Ahmed, minister of finance, budget

and national planning, admitted to this on the

grounds that COVID-19 was good enough

reason to breach the act.

The fiscal responsibility law provides a limit

of three percent debt threshold for

sustainability, but the president can

“exceed

the ceiling if there is a clear and present

threat to national security or sovereignty of

Nigeria”

In 2020, the country’s budget deficit was at

about four percent of GDP, clearly breaking

the law.

On overdraft, section 38, sub-section 1 and 2,

of the CBN Act, said,

“the Bank may grant

temporary advances to the Federal

Government in respect of temporary

deficiency of budget revenue” and “the total

amount of such advances outstanding shall

not at any time exceed 5 percent of the

previous year’s actual revenue of the Federal

Government’.

By the end of 2020, CBN overdrafts to the

Buhari government exceeded the limit by 69

percent of the revenue generated in 2019 – in

a blatant violation of the apex bank rules. The

government’s revenue in the year was N4.1

trillion, and overdraft stood at N2.9 trillion.

Also, Nigeria’s borrowing limit as a percent of

GDP stood at 34.8 percent in 2020, well above1

25 percent for the year. Earlier this year, the

federal executive council (FEC)

had strategically raised the borrowing

limit to 40 percent in its Medium-term debt

management strategy for Nigeria for the

period 2020-2023.

The boy child are the father’s of the society which they are supposed to be taken very seriously especially in our nation Nigeria. Every boy child is entitled to free education and to go to school in other to full fill their dreams in becoming what ever they want and chose to be in future a boy child are the bride winners of the society which should not be taken for granted because without a boy child being educated there is highly a possibility of the nation or country to fall and fail in essence every boy child needs to be educated and a basic and quality education in other to better our society.

Having an interesting online journalism class…

Governor Nasir El-Rufai has just commissioned the Kaduna Galaxy Mall and Neighbourhood Centre.

Galaxy Mall occupies 5.7 hectares expanse of land located at the heart of the Kaduna City Center.

The mall contains retail stores in different sizes, restaurants, cinema, and a major anchor tenant Shoprite Nigeria .

Other facilities include a gate-house, parking pay points, water treatment building, restrooms and a 505 capacity car park to ensure a wholesome experience for all residents and visitors.

Nigerian talented composer and singer, Kizz Daniel aka Vado D’Great delivered this brand new song titled ‘Cough (Odo).’

On the new record, Kizz Daniel makes a collaboration with his signed American record label and publishing company, EMPIRE.

Before the release of this enticing record, Kizz Daniel had initially announced and teased the song, which captured the minds of his music lovers and fans already before its release.

Download from

Wizkid drops the official cover art & track list of his 5th Studio Album, More Love Less Ego❤️🌹🦅

The Assurance ship continues to sail as Davido buys the latest G-Wagon Benz for his third baby mama and fiancee, Chioma.

This sweet news was shared by the car vendor Renee, who Davido contacted to get Chioma her new whip. Renee assured 30BG that this is just one of the cars Davido has ordered for Chioma and others are still on the way. Davido also confirmed the news by liking and commenting on Renee’s post.

OBO’s car gift has pushed many Nigerians to ask the Famous ‘GOD WHEN” question. While some are celebrating the couple’s reconciliation, Some are certain Davido is doing this because Chioma is expecting their second child.